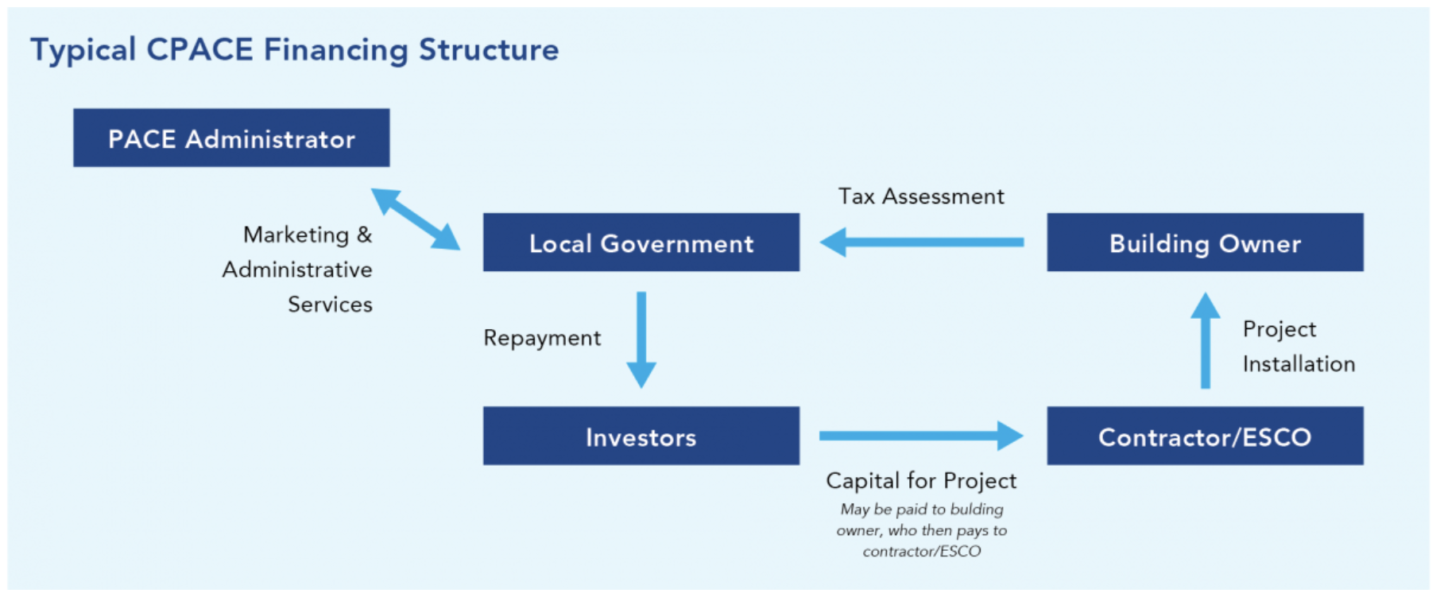

By joining Lean & Green Michigan, Oakland County is facilitating PACE financing by allowing commercial property owners to repay private lenders via a special assessment on their property tax bill. Lean & Green Michigan offers PACE in twenty counties representing more than 62% of all Michiganders. Lean & Green Michigan, a program of Levin Energy Partners, is Michigan's PACE marketplace, growing and managing one, statewide PACE program in collaboration with local governments, lenders, contractors, and property owners. Water efficiency: low flush, low flow, gray water systems, & more.Energy efficiency: lighting, HVAC, & more.Non-profit properties: churches, private schools, cooperatives, & more.Commercial & industrial properties: hotels, restaurants, office buildings, & more.

Pace financing property evaluator pdf#

Request for Approval of Cost-Effective Energy Efficiency Improvement PDF This Guidance Document is for commercial and multifamily buildings only. 100 project financing includes hard, soft and related costs. NYSERDA’s Commercial Property Assessed Clean Energy (PACE) Guidance Document provides guidance on implementing PACE in New York State, as required by New York State General Municipal Law Article 5-L. Non-recourse, non-accelerating capital for commercial, multifamily and industrial property types. Fixed interest rate (negotiated on each deal) Long-term financing for energy efficiency, water efficiency, renewable energy and resiliency projects with repayment through an annual property tax assessment.Solves split incentive problem - payments can be passed easily to tenants.Runs with the land, transferring to subsequent owner upon sale of the property.Long-term financing up to 25 years or the useful life of the project.However, the payback period is simply too long on many energy efficiency and renewable energy measures - so businesses continue wasting energy and money! PACE solves this problem by offering long-term financing at a fixed rate, leading to no upfront cost and immediate positive cash flow. Why PACE?īuildings consume 43 percent of energy in the United States and 30 percent of this consumption is wasted due to inefficiency. Property owners receive 100% pre-funding for energy savings upgrades on their facilities and pay the PACE loan back through a special assessment on their property taxes. Property Assessed Clean Energy, or PACE, is a long-term financing tool for commercial property owners in Oakland County to pay for energy efficiency, water efficiency, and renewable energy upgrades. Current and Future Land Use Maps and Statistics.Community Development Block Grants (CDBG) - Contractors PACE programs allow a property owner to finance the up-front cost of energy or other eligible improvements on a property and then pay the costs back over time.Community Development Block Grants (CDBG).Legal and Financial Webinars for Small Businesses.

0 kommentar(er)

0 kommentar(er)